History

For nearly a century, Forest City owned, developed and managed dynamic commercial, residential and mixed-use real estate in core markets across the United States. The properties spanned 19 states, including Washington, D.C., New York, Los Angeles, Boston, Denver and San Francisco. Known for taking calculated risks, embracing and reinvesting in communities, and designing with long-term value in mind, the Forest City team steadfastly believed in “doing well by doing good, and doing good by doing well.”

Foundation and Development in the Early 20th Century

The family affair began in 1905, when members of the Ratner clan began to immigrate to the United States from their native Poland. Charles, the eldest and first to arrive in Cleveland, Ohio, founded Forest City Lumberyard in 1922. Upon their arrival, Leonard and younger siblings Max, Fannye, and Dora borrowed money to start a small creamery offering milk, butter, and eggs. Trained as a weaver, Leonard joined his older brother in the lumber business mid-decade, opening Buckeye Lumber in 1924. Two years later, the Ratners sold their creameries to focus on the lumber and building materials market. In the late 1920s, Leonard and Charles turned the lumberyard over to brother Max, who had just earned a law degree from Case Western Reserve's John Marshall Law School. Fannye's husband, Nathan Shafran, came into the lumber business around this same time. Leonard and Charles then founded B & F Building Co., which constructed single-family homes on Cleveland's east side. Leonard rejoined the family lumber firm in 1934, bringing with him his expertise in residential construction.

Read more +

Although the company sold construction materials primarily to contractors in the 1920s, 1930s, and 1940s, it had also reached out to the general public during the Great Depression. At this time, Forest City Lumber started a lending program that enabled homeless people to borrow $549 toward the purchase of building materials. By investing their own "sweat equity," these struggling individuals could build a very inexpensive home.

Forest City made its first forays into the real estate business during the 1930s and 1940s by acquiring inexpensive land repossessed by banks and other institutions. Some lots were purchased as cheaply as $10 each. During the interwar period, the company lent land and building materials to local builders with the understanding they would pay for both when the homes were sold. Then Forest City became a pioneer in the construction of prefabricated homes in 1941, but this activity was interrupted by World War II. To help in the war effort, Forest City made wooden munitions boxes for the government.

Sam Miller, who joined the company in 1947, was credited with launching Sunrise Land Co., the land development arm of the business. Miller became a full-fledged member of the family shortly thereafter when he married Leonard's daughter Ruth. Envisioning an opportunity for growth in the postwar housing shortage, the Ratners entered residential construction and were key developers of some of Cleveland's largest suburbs. The group also began to develop its extensive land holdings into apartments and shopping centers. This new focus on consumers may have led the company to begin converting its lumberyards into do-it-yourself home stores in 1955. Forest City's early entry into this important market helped make it Ohio's biggest building materials company by the end of the decade.

Incorporation Signals Transition: The 1960s and 1970s

Forest City Enterprises was incorporated in 1960 with Leonard Ratner as chairman and Max Ratner as president. In an initial public stock offering that same year, the Ratners sold a 19.5 percent stake of the company at a face value of $4.5 million. Forest City's stock was listed on the American Stock Exchange by 1965. Although the company continued to develop its retail and wholesale lumber businesses during the 1960s and 1970s, this corporate reorganization represented a turning point for Forest City, when real estate came to the fore.

Read more +

Beginning in 1966, under the direction of Max Ratner's son Charles, Forest City's building materials chain grew from $12 million in annual sales to nearly $200 million over the next two decades. The division added one of the nation's largest lumber distributors, an Oregon company, to its portfolio in 1969. Over the course of the 1960s and 1970s, it opened stores in Detroit, Chicago, and Akron. By the late 1970s the chain boasted 20 do-it-yourself centers.

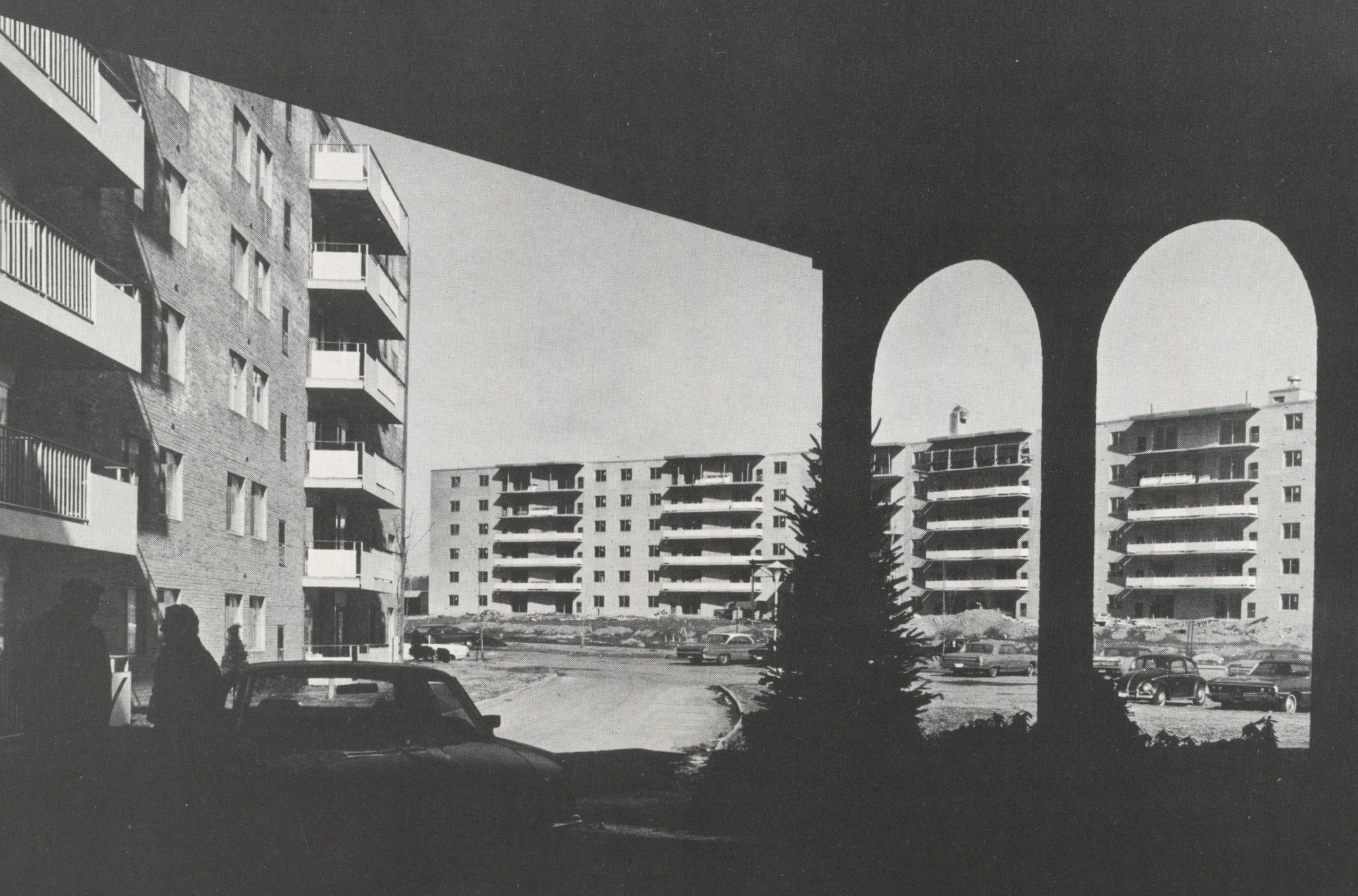

Forest City's real estate developments took several forms. The company built, owned, and operated shopping centers, malls, office buildings, industrial parks, and hotels. It also acquired Akron-based construction firm Thomas J. Dillon & Co., Inc. in 1968. Under the guidance of Nathan Shafran, Forest City applied its patented method of modular high-rise housing construction to this new subsidiary. The firm's "Operation Breakthrough" program erected nearly 60,000 units of low-cost housing for the elderly over the next 30 years. By the end of the 1970s Forest City owned 17 shopping centers and 39 apartment buildings with a combined total of 10,800 housing units. The company had also diversified into mortgage banking, property leasing, and property management, as well as petroleum and natural gas development.

Albert B. Ratner advanced to the presidency in 1973, when Max assumed the chairmanship and Leonard took the title of founder-chairman. Corporate revenues increased from $32 million in 1963 to $235.3 million by 1979, but net income only grew from $1 million to $1.4 million.

The 1980s and 1990s: Major Urban Projects and Foreign Investment

At the dawn of the 1980s, Forest City began to phase out its smaller ventures and concentrate its resources on larger urban developments. The most significant divestment of this transition came in 1987 when the company sold its Forest City Materials chain to Handy Andy Home Improvement Centers, Inc. Forest City had dominated the local home improvement market until the early 1980s, when DIY Home Warehouse and Kmart Corp.'s Builders Square infiltrated Cleveland. Forest City tried to match the competition with deep discounts and a switch to a warehouse format, but soon realized it needed more volume and more buying power to compete with these large, well-financed national chains. This dramatic break with the company's traditional business freed it to focus on the mega-projects for which it would become nationally known in the 1980s and 1990s.

Read more +

Forest City played a key role in the revitalization of downtown Cleveland, then applied the skills it had gained to urban projects throughout the United States. In 1980 the company bought Cleveland's Terminal Tower, a passenger rail terminal originally built before the Great Depression. Although the $250 million project endured several fits and starts, it would become a cornerstone of the city's rebirth. When completed in 1990, the three million-square-foot, multiuse urban renewal redevelopment featured hotels, a mall, and offices. Renamed Tower City, the project helped push Forest City's real estate portfolio over $2 billion in 1991. Major retail and commercial projects in Boston, Pittsburgh, Brooklyn, Los Angeles, Tucson, San Francisco, Chicago, and elsewhere echoed the scale and impact of Tower City in Cleveland. Forest City also continued to pursue residential developments throughout this period, creating everything from single-family inner city projects to luxury apartments and condominiums.

Although Forest City sailed through the late 1980s and early 1990s credit crunch better than many of its competitors, it was compelled to eliminate its quarterly dividend in 1991 and put the brakes on 17 projects in 1992.

Having specialized in large urban redevelopments for about a decade, a confident Forest City wagered future prosperity on international projects and gambling houses. The company made its first international foray via a 1993 joint venture with Mexico's Grupo Protexa. Ian Bacon, the executive in charge of this endeavor, compared Mexico to the United States of the 1950s and 1960s: a market ripe for the development of regional malls and shopping centers.

Forest City became increasingly involved in the construction and management of casinos--euphemistically dubbed "urban entertainment" in the industry--in the mid-1990s. Projects in Pittsburgh, Las Vegas, and Atlantic City either planned for or proposed gambling. Although gambling and its social and economic effects were hotly contested topics in the early 1990s, analyst Sheldon Grodsky wryly told the Cleveland Plain Dealer's Bill Lubinger that, "This is what they do, whether they do it with gambling-related property or retail or mixed use or apartments--that's real estate development." Clearly Forest City and the Ratner family had long been winners at the real estate game, and there was no reason to believe a losing streak was at hand.

Charles A. Ratner, son of Max, became president and chief operating officer, then assumed the role of chief executive officer in 1995 after his father's death. The year also marked the company's 75th anniversary and Forest City's new CEO revealed a strategic plan outlining financial goals and the strategies necessary to reach them, a mission statement, and a set of core values. Two years later, in 1997, the company moved its stock listing from the American Stock Exchange to the New York Stock Exchange. Also in 1997, Forest City moved its corporate headquarters to Tower City, its recently developed high-profile Cleveland property.

Novel Projects As Company Enters the New Millennium

Forest City closed out the 20th century with a burst of urban development activity. Among the projects the company completed in 1998 and 1999 were a large office building in the Massachusetts Institute of Technology's University Park; a luxury apartment high-rise in Bethesda, Maryland; a mall near San Diego, California; and a shopping center in New Jersey. James Ratner, as the Chairman and CEO of Forest City’s Commercial Division, spearheaded the University Park at MIT project, which added significantly to Forest City’s net value as a large, urban mixed-use project. As these new properties were opening, Forest City had plenty in the pipeline to replace them. In 1998 alone the company launched more than a dozen projects. Two of the most high profile jobs were on opposite coasts: in New York City, the company began construction of a 300,000-square-foot hotel and entertainment complex in Times Square, while in San Francisco it kicked off redevelopment of the city's historic Emporium building near Union Square.

Read more +

One of its largest and most unusual projects came in 1999 when Forest City was awarded the $4 billion job of redeveloping Denver's obsolete Stapleton Airport. Under the direction of Ron Ratner, President and CEO of Forest City’s Residential Business, Stapleton began its long-term growth and development as a new, master-planned community. The project--which was delayed by numerous obstacles before finally getting underway in early 2001--involved converting some 3,000 acres of former airport land into a community complete with housing, retail, and office space. By the time the company broke ground on the Stapleton project, it was in the midst of planning for a number of other developments including a Times Square headquarters for the venerable New York Times Company; a one million-square-foot mall near Richmond, Virginia; an upscale shopping area in Pasadena, California; and a state-of-the-art facility in Cleveland, designed to house telecommunications and IT companies.

In 2001, as businesses across the United States struggled with a difficult economy, Forest City weathered the storm well. For the year, the company achieved record results in both revenues and earnings and took steps to strengthen its financial liquidity. It also made a secondary public offering of 3.9 million shares (which generated $118 million) and sold seven properties, including a $108 million mall in Tucson. The influx of capital allowed the company to reduce its nonrecourse mortgage debt by almost $96 million.

Forest City stormed into 2002, completing nine property acquisitions and opening five new developments all in the first half of the fiscal year. It also continued to make significant progress in ongoing developments at Denver's Stapleton Airport and MIT's University Park. For the second quarter, the company posted an increase of around 8 percent in both revenues and earnings over the same period in 2001.

Barring unforeseen events, the company appeared likely to continue in an aggressive development mode. In a September 2002 press release, Forest City President Charles Ratner said the company expected to complete at least five more retail projects during the year, as well as reach several milestones at the Stapleton project. In addition, there were 18 projects in construction--eight residential communities, three office developments, and seven retail centers.

2002–2007

2006 was a year of landmark achievements. The opening of the 1.5 million square foot San Francisco Center was a milestone event for Forest City. Although it took over a decade, the company overcame obstacles to make sure the vision was achieved. Operating results were immediately strong, with 90% leased at opening. The growth story of San Francisco Center marked it as another financial and aesthetic success for Forest City. Also in 2006, in one of the most significant achievements in the company’s history, ownership of Forest City Ratner Enterprises was consolidated. This strengthened the company’s position in their largest single market, New York City, by increasing the interest in 30 operating properties in the greater metropolitan area, and gaining full ownership rights to all future FCRC development opportunities in the market.

Read more +

After securing its first military housing development opportunity in 2004, the scope of the company’s military housing projects grew year over year. Forest City proved to be a good fit for the Department of Defense’s Military Housing Privatization Initiative (MHPI), under which a 50-year public/private venture agreement was signed with branches of the armed forces. Throughout 2006 and 2007 in particular, military family housing became a stronger part of the Forest City residential business. Leveraging multifamily residential experience, Forest City was dedicated to creating safe, friendly neighborhoods featuring community centers and a variety of other public amenities suited for young families. At the end of 2007, Forest City had approximately 12,000 military housing units under management.

2007 marked the grand opening of a new urban landmark, the 1.5-million-square-foot New York Times Building, which immediately became Forest City’s largest single asset. It stood as a testament to the company’s commitment to urban development and ability to attract premier partners and tenants. At yearend, Forest City had many projects in development, including retail centers in NY and DC, office/life sciences projects in CO, IL, NM, MD and DC, and residential in NY, TX, CA and DC. Mesa del Sol, a long-term, mixed-use project in Albuquerque, was one of the most significant stories of the year. Sony Pictures Imageworks, Fidelity Investments and SCHOTT Solar Inc. announced plans for building facilities totaling more than 450,000 sq. ft. of commercial space at Mesa del Sol—bringing the total committed or opened space to 1.2 million square feet. The Company also began construction on the first town center for Mesa del Sol.

Although Forest City was creating significant net asset value through strong operating results and new property openings and acquisitions, the company’s EBDT decreased for the first time in 27 years. The land business was declining, and Forest City was feeling the beginnings of the 2008 financial crisis. However, the company had persevered through many economic downturns in its long history, and it would weather this storm, too.

As the worldwide crisis began to take full effect, Forest City responded by taking responsible action and making necessary changes. There were key elements that the company prioritized in order to manage through tough conditions: significantly slowing the development pipeline, driving costs out of the business, proactively managing debt maturities, seeking opportunities to generate liquidity through sales and joint ventures, and taking advantage of opportunities created by market conditions. At the end of fiscal year 2008, the company had only 8 projects under construction, and remained cautious in near-term outlook. However, they always maintained faith in having high-quality assets in good markets, which in turn represented real value, even in a down market.

The Forest City land business was hit hardest by the bursting of the housing bubble, the turmoil in the financial sector and the recession. Existing pipeline projects were slowed significantly, and far fewer projects were opened in 2009 than in years previous. Only one project saw construction commence, Master Closing complete, and groundbreaking celebrated in 2009: Barclays Center arena in Brooklyn, NY. With this development, Forest City focused on providing Brooklyn with economic benefits, housing, jobs and revitalization, all within the Atlantic Yards project umbrella. As the dust cleared after the financial crisis, Forest City continued to focus on the positive results of core markets and key urban centers. The company forged ahead—albeit with a guarded outlook—despite the lingering weakness in the economy and real estate business.

2010–2017

In 2010, Forest City celebrated its 50th year as a public company, and 90th year since founding. The company marked the milestones with a record total EBDT. Foundry Lofts, the first residential building at The Yards, broke ground. The Presidio Landmark, an adaptive reuse project that utilized a historically significant former US Health Service Hospital in Presidio National Park in San Francisco, was built to a high standard of sustainability. It opened and began active leasing to immediate success. Forest City’s commitment to sustainability continued to be one of its hallmarks. Jon Ratner was first C-Suite sustainability executive of a public real estate company in the US, and led to the adoption of green building standards throughout the majority of FC’s operating portfolio and development pipeline for nearly twenty years, beginning most notably at Stapleton.

Read more +

A management succession plan was announced, with Charles Ratner becoming chairman of the board and David LaRue becoming president and CEO in 2011. Albert Ratner and Sam Miller became co-chairmen emeritus, remaining active with the company but no longer serving on the board. In early 2012, Forest City launched a strategic plan built on three key pillars: to focus on core markets and products, to build a strong, sustainable capital structure, and to drive operational excellence in all areas. The company undertook major process improvements and efficiency initiatives that led to meaningful savings and a renewed commitment to continuous improvement and operational excellence.

Another significant partnership came to Forest City in 2012: the creation of a $400 million residential development fund with the Arizona State Retirement System. B2 BKLYN at Atlantic Yards and 2175 Market Street in San Francisco were the first two apartment projects created with the fund. Stapleton continued to thrive, and was rated among the top 10 best-selling master-planned communities by Metrostudy, a national real estate rating service.

Throughout the decade, Forest City took advantage of improved economic conditions and growing demand for rental apartments. In 2013 and 2014, the company opened a multitude of significant properties, including The Yards in Washington, DC, Radian in Boston, 2175 Market Street in San Francisco, and 3700M in Dallas. The company also continued to expand upon its past developments. Aster Conservatory Green, a 352-unit apartment community at Stapleton, and 300 Massachusetts Ave., a 246,000 square foot office building at University Park at MIT, were some of the new additions to prior projects.

In January 2015, Forest City announced that the Board of Directors approved a plan to convert to real estate investment trust (REIT) status, effective January 1, 2016. This watershed decision helped accelerate efforts to transform the company, executing the strategic plan and generating increased shareholder value. The decision aligned Forest City more closely with the majority of publicly traded peers, exposed the company to a wider universe of investors, provided a dividend stream to shareholders, allowed the company to be included in major industry indexes, and improved overall access to capital markets.

The Forest City Board announced a plan in 2016 to reclassify the company’s stock, eliminating the company’s dual-class share structure. In the same year, the company completed $1.3 billion gross value of dispositions and joint ventures, including the disposition of interest in the Barclays Center arena and the NBA Nets, the Forest City military housing business, a development parcel in Brooklyn, and the Terminal Tower office building in Cleveland, as well as joint ventures for three regional malls. The company also sold interests in 47 federally-assisted housing apartment communities.

During this time of financial shifting, Forest City continued to open new properties. Arris, an apartment community at The Yards, and Blossom Plaza, an apartment community in Los Angeles were two highlights. Projects were also opened in Baltimore, Brooklyn, Philadelphia and more. At the end of 2016, Charles Ratner retired as Chairman of FC’s Board of Directors, bringing to a close a 50-year career of remarkable achievement and leadership. With Chuck’s retirement, the board appointed James A. Ratner to serve as chairman of the board in a non-executive capacity. Bruce C. Ratner, founder of the New York subsidiary and a director since 2007, also stepped down from the board at yearend.

2017 brought announcements of two large-scale developments in San Francisco: Pier 70 and 5M. Kevin Ratner, President of Forest City West Coast, oversaw these developments, utilizing his expertise in revitalizing urban neighborhoods with a focus on placemaking. Pier 70, a 28-acre waterfront site with residential, commercial and manufacturing/maker uses, as well as parks, transportation and infrastructure upgrades, combined both adaptive reuse and new builds. Throughout the year, Forest City opened nine new properties in the core market, including Mint Town Center, a 399-unit apartment community in Stapleton with 7,000 square feet of street-level retail.

In 2018, Brookfield Asset Management, Inc. acquired Forest City Realty Trust, Inc. Forest City’s existing common stock was delisted from the New York Stock Exchange at the close of business on December 7, 2018. Brookfield acquired all outstanding shares of common stock of Forest City for $25.35 per share in an all-cash transaction valued at $11.4 billion. Members of the founding families re-emerged as two new real estate entities: The Max Collaborative and Uplands. TMC is owned and operated by members of the Max Ratner family—and it aspires to build upon Forest City’s legacy of thoughtful, innovative, prosperous, community-centric real estate well into the next century.

1920s

Charles Ratner founds Forest City Lumberyard in Cleveland, Ohio.

Ratner's brother Leonard founds Buckeye Lumber.

Charles and Leonard form B&F Building Co. to construct homes in Cleveland.

1930s

Forest City begins acquiring real estate in the Cleveland area.

1940s

Forest City begins building prefabricated homes.

1950s

The Ratners begin converting their lumberyards into do-it-yourself home stores.

1960s

Forest City becomes a public company and joins American Stock Exchange.

The company opens its first enclosed regional mall, Boulevard Mall in Amherst, N.Y.

Forest City enters office building market with Chagrin Plaza in Beachwood, Ohio.

The company acquires an Akron, Ohio, construction company.

1970s

Forest City enters California market; unveils proprietary pre-fabricated concrete building system for apartments; expands its retail building materials business into larger, full-service stores.

Forest City owns 17 shopping centers and 39 apartment buildings.

1980s

Forest City acquires and renovates historic Tower City Center, an art deco train station originally built in the 1920s, spurring resurgence of downtown Cleveland.

The Company creates partnership with Forest City Ratner Companies in New York City; is named master developer of MetroTech Center office Brooklyn; completes its first New York City office building, One Pierrepont Plaza.

Forest City is named master developer of University Park at MIT life sciences mixed-use community near Boston; enters into joint venture to develop Central Station project in Chicago; exits retail stores business.

Forest City sells its home store chain.

1990s

Forest City begins adaptive reuse of turn-of-the-century tobacco warehouses for transformation into The River Lofts at Tobacco Row rental residential community in Richmond, Virginia.

The Company is selected master developer of Stapleton, the mixed-use redevelopment of Denver’s former airport; project is catalyst for the company’s commitment to sustainability.

The Company dramatically expands its urban retail portfolio with new centers and major renovations in New York City, Pittsburgh, California, Nevada and elsewhere.

The Terminal Tower redevelopment is completed and renamed Tower City.

Forest City's real estate portfolio reaches $2 billion.

Forest City partners with a Mexican company to develop commercial properties in Mexico.

The company moves its headquarters into the new Tower City complex.

2000s

Forest City breaks ground on the redevelopment of Denver's former Stapleton Airport.

The company exits legacy lumber trading business and senior housing market, and enters military family housing business.

Forest City completes urban retail property, San Francisco Center, which features a completely restored 500,000-pound steel and glass dome.

FC celebrates grand opening of NYT building; secures entitlements for Atlantic Yards project in Brooklyn; and begins development at the Yards and Waterfront Station mixed-use projects in Washington D.C.

2010–2017

In 2010, Forest City celebrates its 50th year as a public company, and 90th year since founding.

A management succession plan is announced, with Charles Ratner becoming chairman of the board and David LaRue becoming president and CEO.

Stapleton is renamed as Central Park Denver, and sees much success throughout the decade. FC opens apartment communities Aster Town Center and Aster Conservatory Green at the development. Central Park Denver is rated among top 10 best-selling master-planned communities by Metrostudy, a national real estate rating service.

The creation of a $400 million residential development fund with the Arizona State Retirement System is announced, with B2 BKLYN at Atlantic Yards and 2175 Market Street in San Francisco as the first two apartment projects in the fund.

The Board of Directors converts to real estate investment trust (REIT) status on January 1, 2016.

Charles Ratner retires as Chairman of FC’s Board of Directors, bringing to a close a 50-year career of remarkable achievement and leadership. Bruce Ratner, founder of the New York subsidiary and a director since 2007, also steps down from the board.

FC opens properties in NY, FL, CA, TX, CO, MA, PA and more. Highlights include Blossom Plaza in Los Angeles, 2175 Market Street in San Francisco and Ballston Quarter Residential in Arlington, VA. The Yards is completed, and is named by multiple local and regional media outlets as Washington, DC’s hottest new neighborhood.

Pier 70 and 5M are announced as upcoming developments in San Francisco. 5M as a mixed-use district planned for a four-acre downtown site, and Pier 70 as a 28-acre waterfront site including residential, commercial and maker uses, as well as parks, and transportation and infrastructure upgrades.

2018

Brookfield Asset Management, Inc. acquires Forest City. Acquisition includes all outstanding shares of FC common stock in an all-cash transaction valued at $11.4 billion. FC’s stock is delisted from the New York Stock Exchange at the close of business on December 7, 2018.